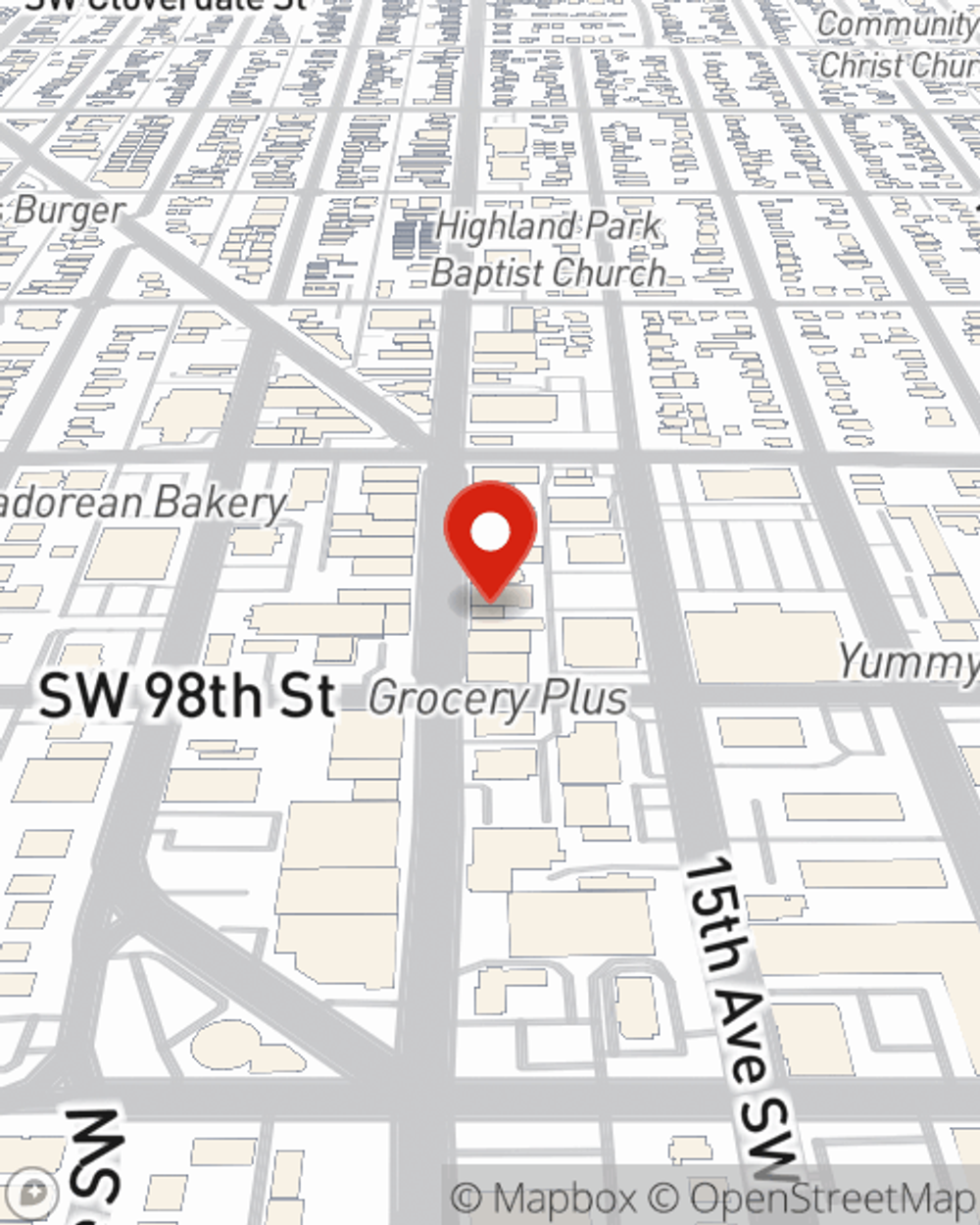

Business Insurance in and around Seattle

Calling all small business owners of Seattle!

No funny business here

Coverage With State Farm Can Help Your Small Business.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected problem or loss. And you also want to care for any staff and customers who hurt themselves on your property.

Calling all small business owners of Seattle!

No funny business here

Protect Your Future With State Farm

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like business continuity plans or extra liability, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent Heather Proctor can also help you file your claim.

So, take the responsible next step for your business and contact State Farm agent Heather Proctor to explore your small business insurance options!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Heather Proctor

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.